Or email info@ArlingtonWealthPlanning.com

Our goal is to provide a

better retirement plan.

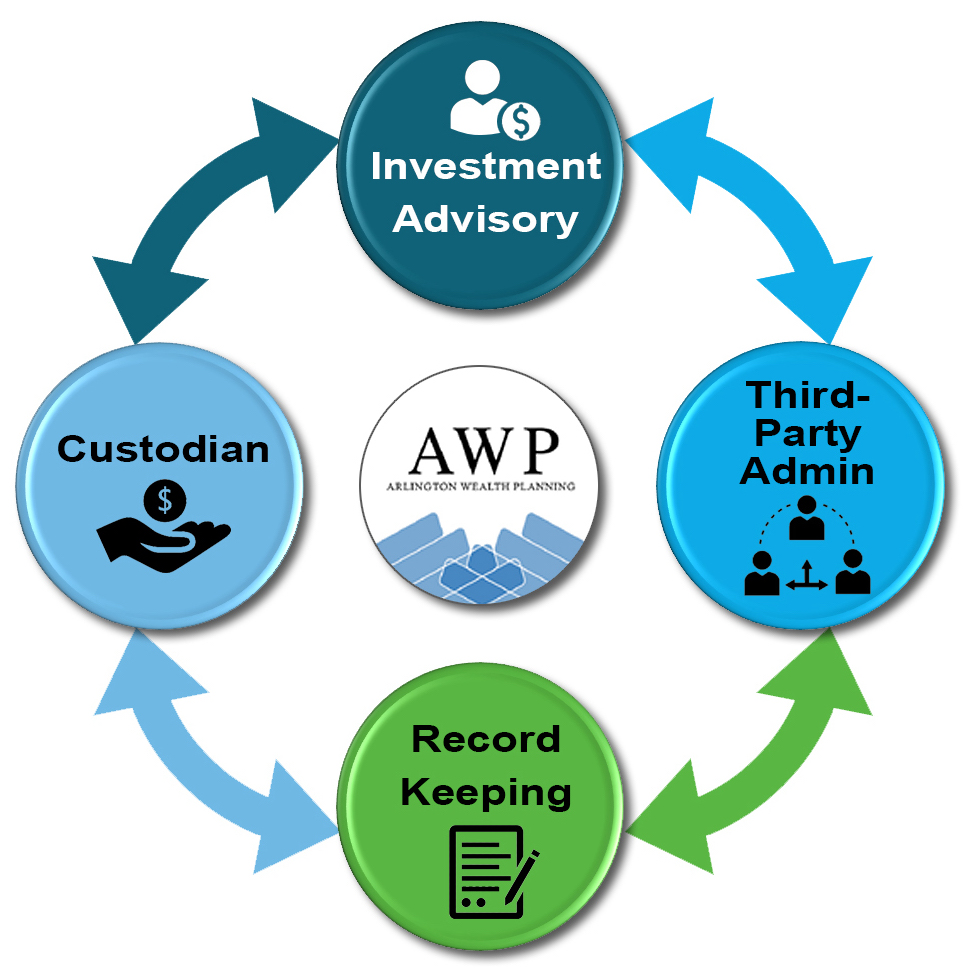

To provide better retirement plans, we have assembled an award-winning team that has decades of experience with record keeping, administration, and investment policy management. We couple this with advisory services that provide regular and recurring touch points with the participants so that we can provide value through ongoing financial education.

Whether you are starting your own company and want to implement a corporate retirement plan, or you have an existing plan and are unhappy with the service you are getting, call us today to discuss the services we provide. For existing plans, we run an industry diagnostic to determine how your plan stacks up. We also run a side-by-side comparison between your plan and ours – all with no obligation.

We provide a 401k Plan that:

- Is customizable, with employee engagement options that augment employee wellness programs and enhance financial well-being

- Includes a professional client portal with innovative tools that create a quality customer experience and empower participants to evaluate their financial status.

- Is built on a foundation of experienced high-quality fiduciary, administrative, recordkeeping, and custodial support that make offering a reliable retirement program easy and worry-free.

Our vision is to increase access to financial planning, so that those who typically don’t have access can gain it through their company’s retirement plan

Not only will we sit down with your employees to make sure they know what each and every fund offers, but we will work through financial planning concepts in group seminars. We will discuss topics such as how much they need for retirement, how much they need to save to achieve their retirement goal, budgeting, risk management, college savings, debt management, etc.

We will not only provide information, but we will provide tools and methods so that employees walk away with actionable information specific to their situation.

Why This Is Important:

You want enhanced advisory services not only so that the participants feel like they are getting their money’s worth out of the plan, but so that you can rest assured that your employees are getting help with managing their finances. You can help to strengthen their financial position and strike a workable work/life balance. Businesses looking to stay competitive in today’s tight labor market should understand why these employee benefits are important.